Tangerine Holdings

Elevating Cleaning Standards, One Space at a Time.

Tangerine Holdings

Elevating Cleaning Standards, One Space at a Time.

Our Mission

Tangerine Holding’s mission is to is to elevate the standard of cleanliness and hygiene in every space we touch. We believe that a clean environment is fundamental to well-being, productivity, and peace of mind. Our mission is to provide meticulous, reliable, and eco-friendly cleaning solutions tailored to the unique needs of each client, whether in their homes, workplaces, or commercial establishments.

Our Objective

Tangerine Holdings is dedicated to acquiring cash-flowing cleaning companies in Australia with an EBITDA between 18% and 26%. Our acquisition strategy is set to begin in the third quarter of 2024, with a focus on ensuring a seamless transition from the previous owner, which we anticipate will take between 6 to 18 months. We deeply value and intend to preserve the legacy of each business we acquire, integrating their strengths into our broader operational network. Tangerine Holdings will operate with a decentralized model, allowing each acquired company to maintain its unique identity while benefiting from centralized support and resources.

Industry Overview

Tangerine Holding’s mission is to is to elevate the standard of cleanliness and hygiene in every space we touch. We believe that a clean environment is fundamental to well-being, productivity, and peace of mind. Our mission is to provide meticulous, reliable, and eco-friendly cleaning solutions tailored to the unique needs of each client, whether in their homes, workplaces, or commercial establishments.

The commercial cleaning industry in Australia has experienced significant fluctuations over the past few years, primarily driven by the COVID-19 pandemic and its aftermath. The pandemic led to widespread government restrictions that forced retail, hospitality, and office spaces to close or reduce operations. As a result, demand for commercial cleaning services plummeted, causing industry revenue to decline. However, the industry is showing signs of recovery, with a projected return to steady growth in the coming years

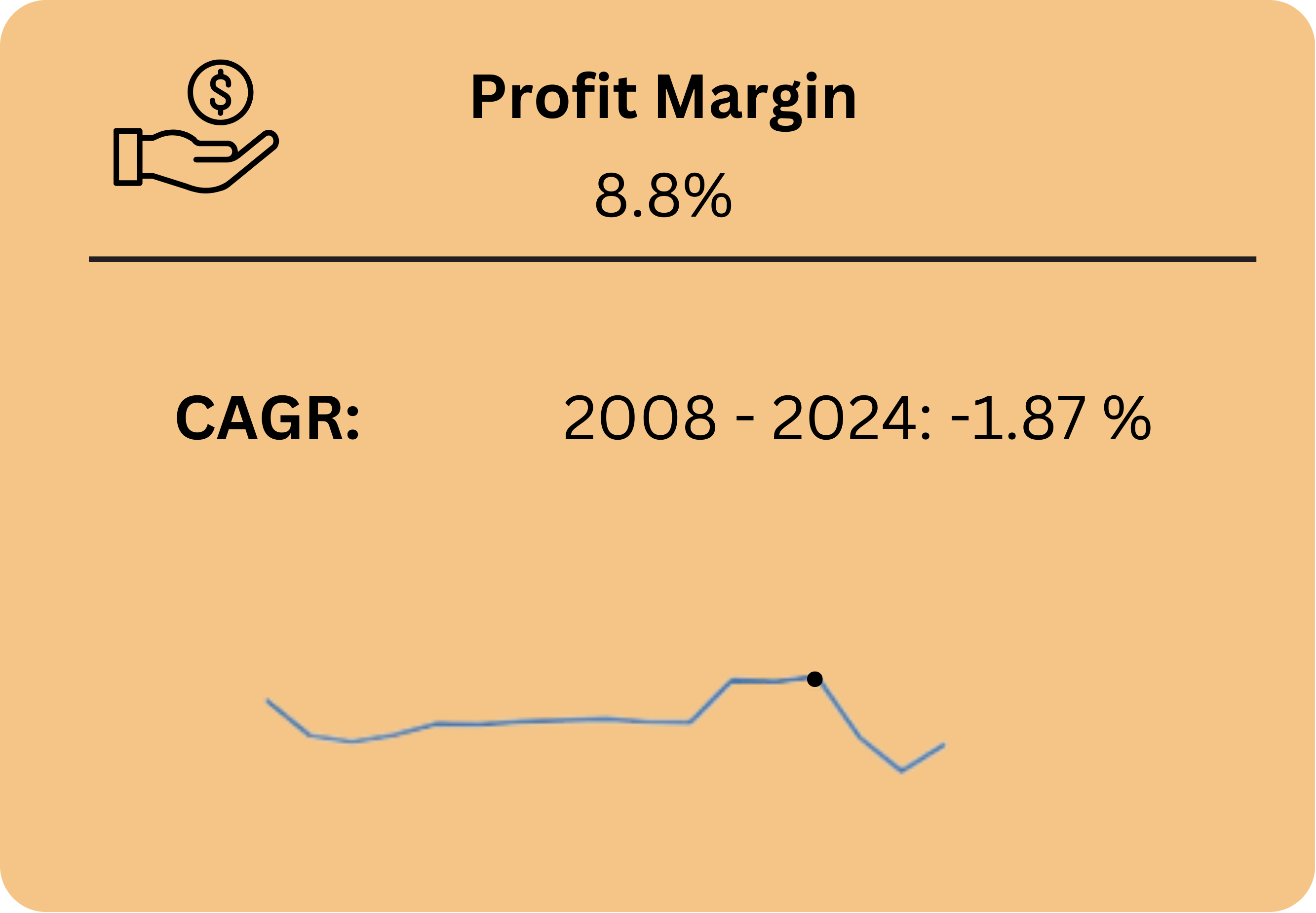

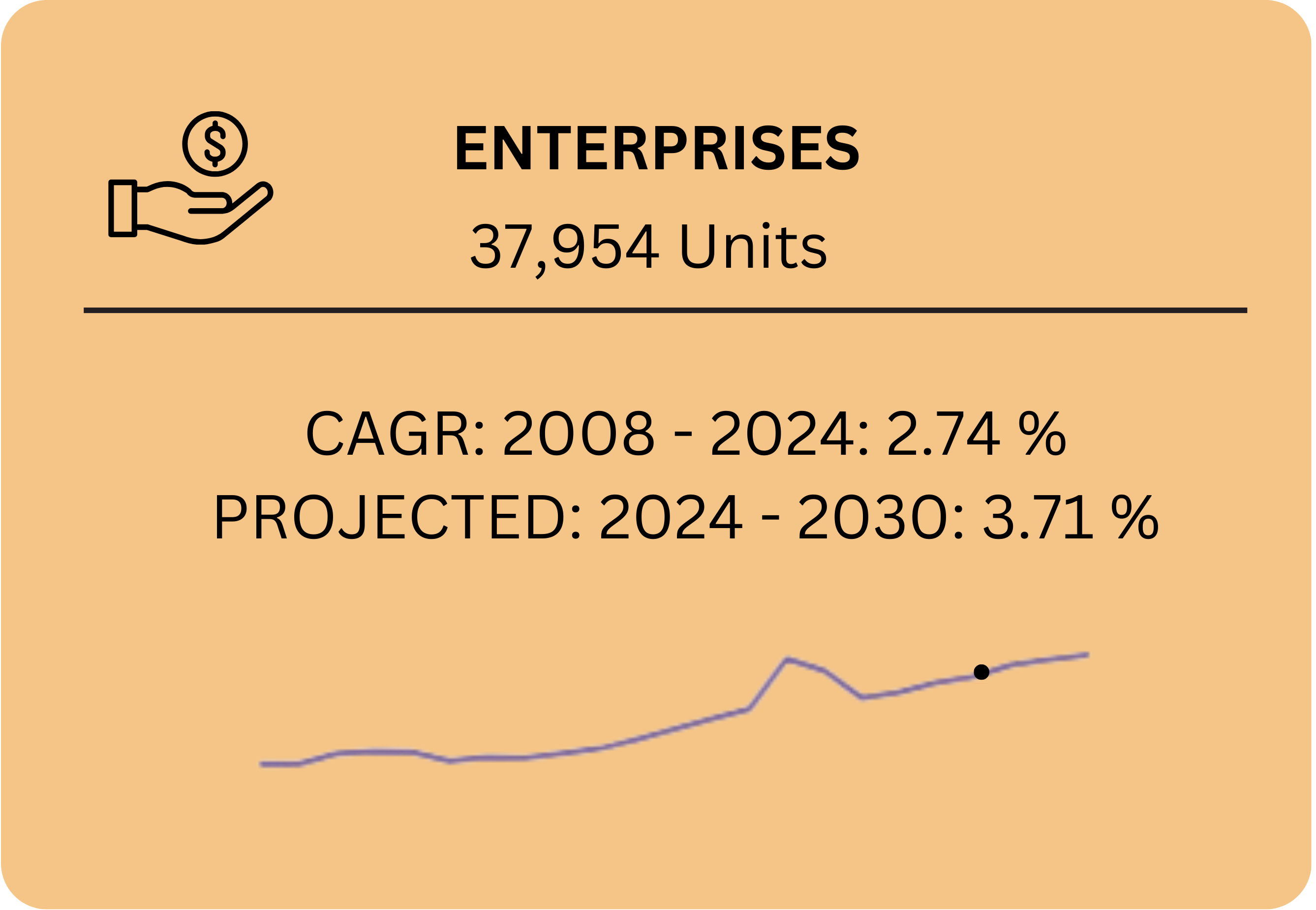

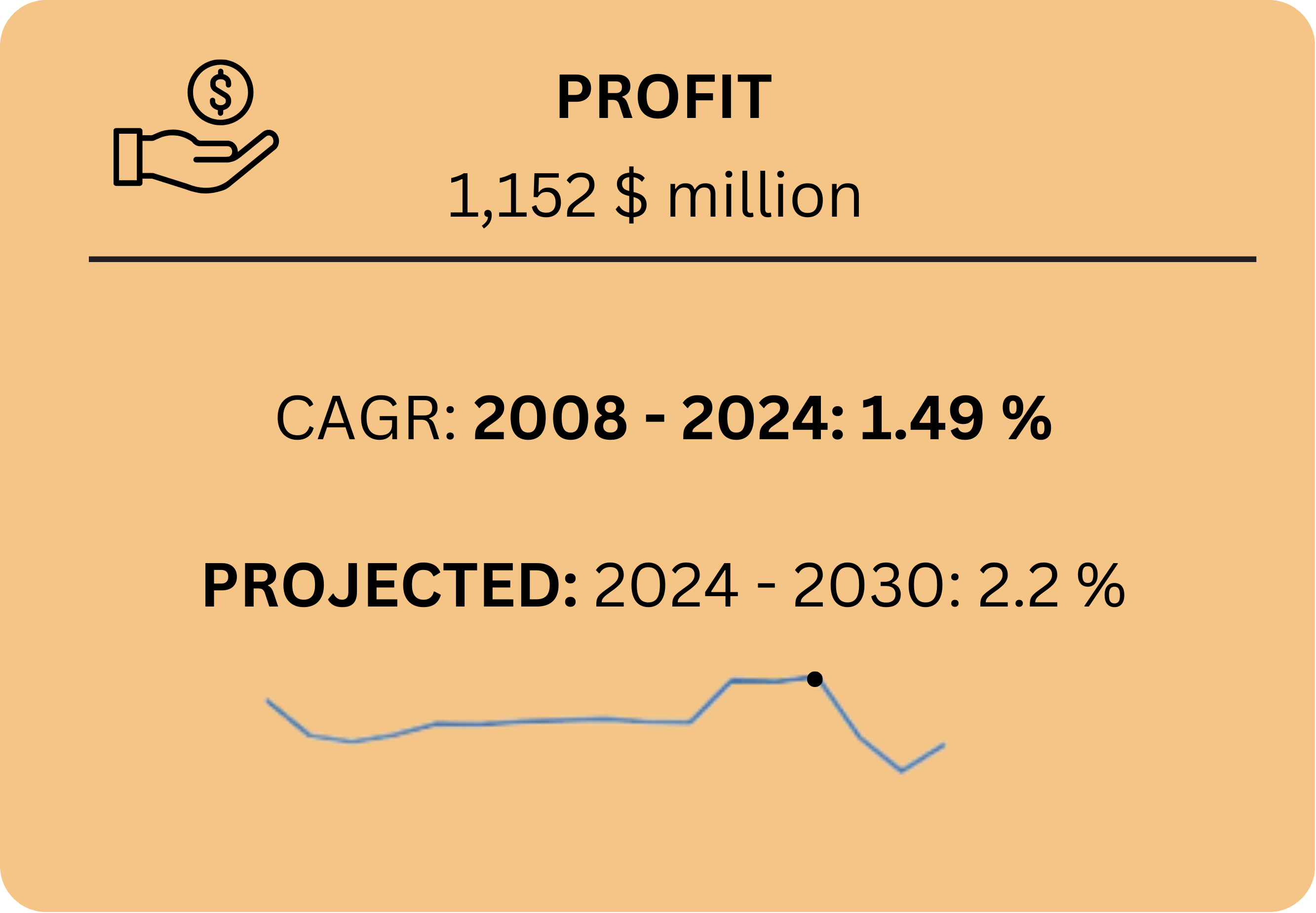

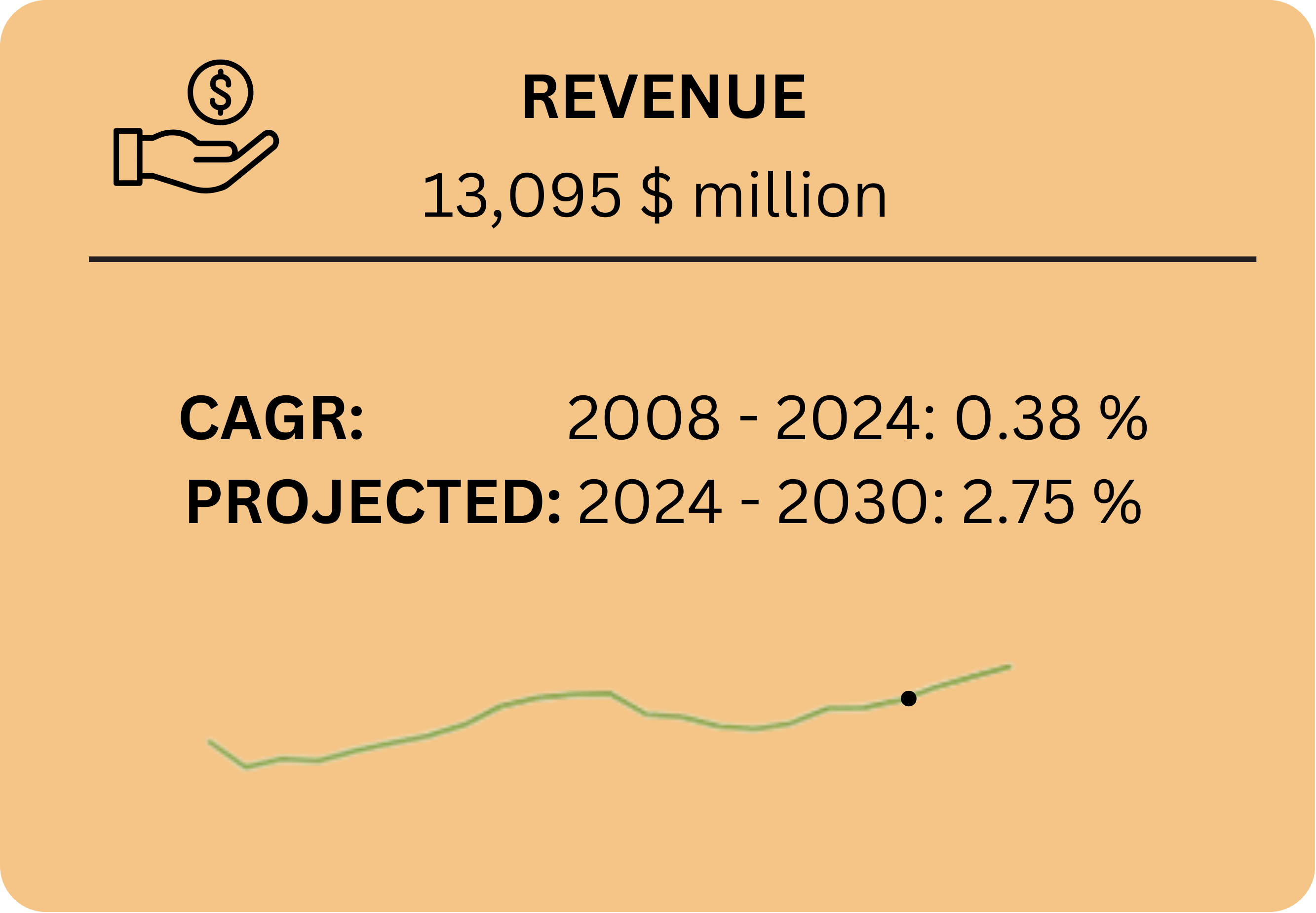

In 2024, the industry recorded a profit of $1.152 billion, with a profit margin of 8.8%. However, the industry faced a compound annual growth rate (CAGR) decline of 1.49% in profit and 1.87% in profit margins from 2008 to 2024. This decline reflects the industry’s struggle to maintain profitability amidst rising costs and fluctuating demand. The industry’s revenue stands at $13.095 billion in 2024, with a modest CAGR of 0.38% from 2008 to 2024. Despite the challenges posed by the pandemic, the industry is projected to experience a revenue growth of 2.75% from 2024 to 2030, indicating a positive outlook driven by increasing demand for specialised cleaning services. Employment in the industry totals 146,641 units in 2024, with a CAGR of 1.80% from 2008 to 2024. However, employment is projected to decline by 1.68% from 2024 to 2030, as firms invest in efficiency technologies that reduce the need for labour.

- The IVA, which measures the industry’s contribution to the economy, stands at $6.511 billion in 2024. The IVA has grown at a CAGR of 1.09% from 2008 to 2024 and is expected to accelerate to a CAGR of 1.97% from 2024 to 2030, reflecting the industry’s recovery and growing economic importance.

The commercial cleaning industry is expected to return to a stable growth trajectory over the coming years. The number of businesses in Australia is projected to increase, driving demand for commercial cleaning services. Additionally, the growing awareness of the importance of hygiene and cleanliness, particularly in the wake of the pandemic, is expected to boost demand for specialised cleaning services. Investment in efficiency technologies, such as smart sensors and employee apps, is forecast to reduce labour costs and improve profitability. However, the industry will need to adapt to increasing environmental and sustainability requirements, with larger firms already taking steps to reduce their carbon footprint and water usage. Overall, the industry is poised for a period of steady growth, with revenue projected to rise at an annualised rate of 2.8% through 2028-29, reaching $15.0 billion.

Geographical Overview

Tangerine Holdings’ acquisition strategy for expanding its presence in the Australian commercial cleaning industry is guided by a geographical overview that carefully considers the regulatory environment, market demand, and economic conditions across different states and territories. While Tangerine Holdings is committed to expanding its operations nationwide, it will prioritize regions where demand for commercial cleaning services is robust and the regulatory landscape is favorable.

The company recognizes that each state and territory has its unique market dynamics and regulatory requirements, which can impact business operations and growth potential. For instance, states like New South Wales and Victoria offer significant opportunities due to their large commercial hubs and high concentration of businesses, making them prime targets for acquisition. On the other hand, Tangerine Holdings may approach expansion in states with smaller markets, such as Tasmania and the Northern Territory, more cautiously, focusing on niche opportunities that align with its overall growth strategy.

By carefully assessing the market and regulatory conditions in each state, Tangerine Holdings aims to identify the most promising opportunities for growth while minimizing potential risks. This strategic approach allows the company to build a strong and sustainable presence in the Australian commercial cleaning industry, ensuring long-term success across diverse geographic areas.

Business Strategy

Tangerine Holdings will strategically focus on acquiring small to medium-sized cleaning companies that have established a strong market presence in major Australian urban centers. Target companies will have a minimum revenue of 1 million AUD and an EBITDA between 18% and 26%. We will prioritize businesses offering specialized services, such as deep cleaning and disinfection, to tap into niche markets. The acquisition process will involve thorough due diligence to ensure that the target companies align with our long-term goals. Post-acquisition, we will maintain the unique identity and client relationships of each business while integrating them into our decentralized operational model. This approach will ensure operational efficiency and brand continuity across our portfolio.

To drive operational excellence, Tangerine Holdings will invest heavily in advanced technologies. Smart sensors and tracking apps will be implemented across all operations to monitor and respond to cleaning needs in real time, significantly improving resource allocation and service quality. Data analytics will play a crucial role in decision-making, enabling us to optimize performance metrics, enhance client satisfaction, and streamline operations.

Tangerine Holdings’ geographic expansion will begin with a focus on acquiring well-established cleaning companies in Australia’s major urban centers, including Sydney, Melbourne, Brisbane, and Perth. These cities present the highest demand for commercial cleaning services due to their dense concentration of office spaces, retail centers, and hospitality venues.

Tangerine Holdings is committed to transforming the commercial cleaning industry in Australia by setting new benchmarks for quality, efficiency, and sustainability. Our long-term goal is to become a leader in eco-friendly cleaning solutions, reducing the environmental impact of cleaning services through innovative practices and technologies.

To ensure operational consistency and excellence, Tangerine Holdings will standardize procedures across all acquired companies. This includes implementing shared best practices, technology platforms, and quality control measures to maintain high standards of service delivery. Centralized support functions, such as HR, finance, and marketing, will be provided to all business units.

The success of Tangerine Holdings hinges on the quality of our workforce. We will focus on recruiting skilled and experienced cleaners, particularly those with expertise in specialized cleaning services. Comprehensive training programs will be developed to ensure that all employees are proficient in the latest cleaning technologies, sustainable practices, and customer service excellence. These programs will include both initial training for new hires and ongoing professional development opportunities for existing staff.

Our plan is to retain the original business name and branding, preserving its unique character and legacy. This approach not only respects the founder’s legacy, which is often important to retiring sellers, but also provides competitive advantages over larger, branded acquirers.

High competition within the industry will be mitigated by our focus on acquiring established companies with strong market positions and by differentiating our services through technological innovation and sustainability practices. The low barriers to entry that lead to market saturation will be countered by our emphasis on premium, specialized services that are difficult for new entrants to replicate