Tangerine Holdings

Sustainable NDIS Providers for Stronger Communities.

Tangerine Holdings

Elevating Cleaning Standards, One Space at a Time.

Our Mission

Tangerine Holdings’ mission is to raise the standard of swim education across Australia. We believe that confident, water-safe children start with compassionate, high-quality swimming programs. Our goal is to support swim schools that deliver safe, engaging, and effective aquatic learning environments—while preserving what makes each school unique.

Our Objective

Tangerine Holdings is focused on acquiring profitable, community-trusted NDIS providers across Australia with strong compliance, stable participant bases, and sustainable operations. Our acquisition strategy ensures a respectful transition for owners seeking to exit, typically over a 12 to 24 month period. We are committed to maintaining the unique identity and service philosophy of each provider we acquire, while offering access to centralised support and resources. By operating under a decentralised model, we empower local teams and managers to retain their independence while continuing to deliver high-quality, person-centred care for participants.

Industry Overview

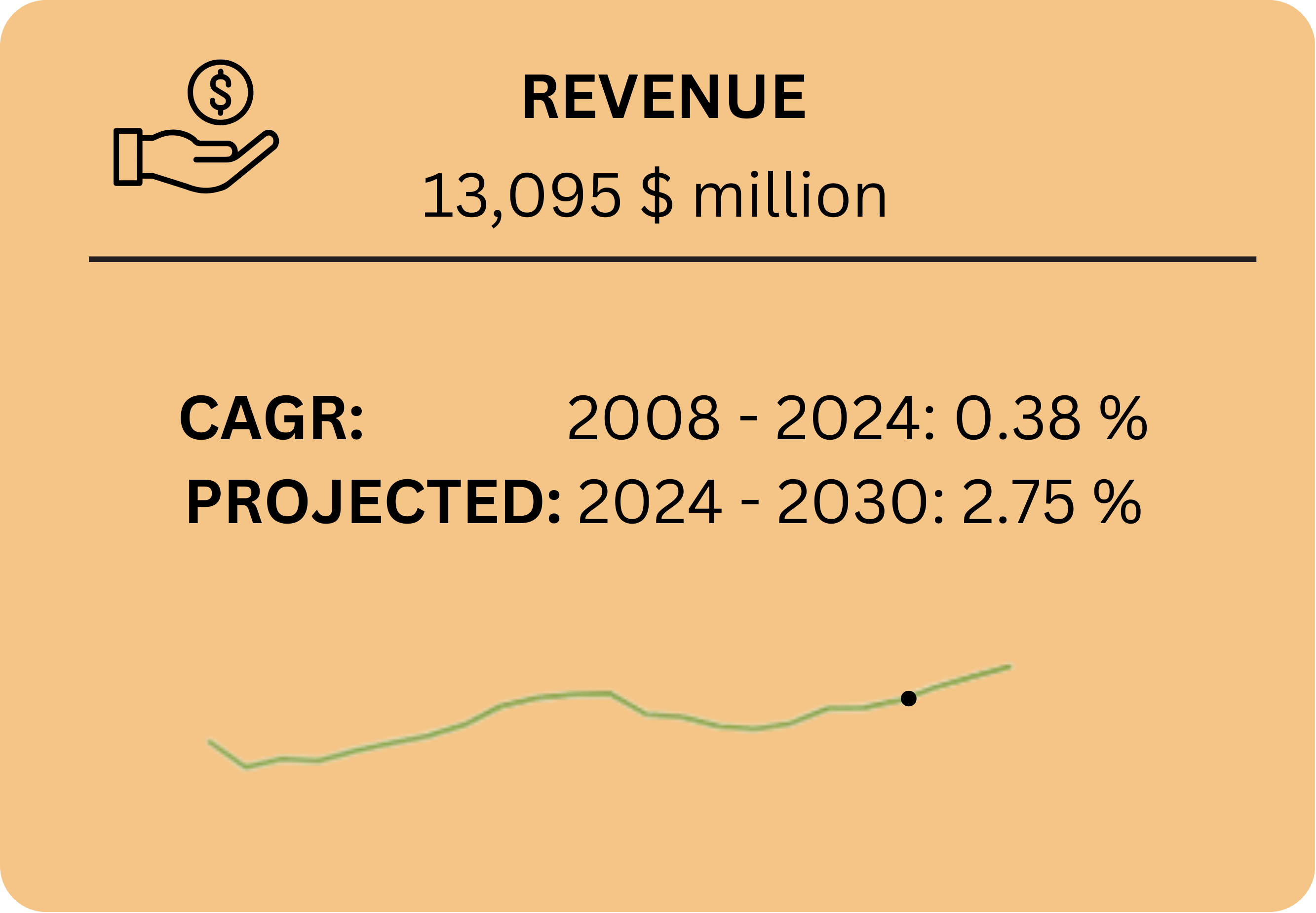

The NDIS services industry in Australia is part of the broader disability care and community services sector and has experienced steady growth driven by increasing participant numbers, strong government funding, and rising demand for individualised support. Providers delivering plan management, support coordination, and core supports are central to ensuring participants can access high-quality care and outcomes.

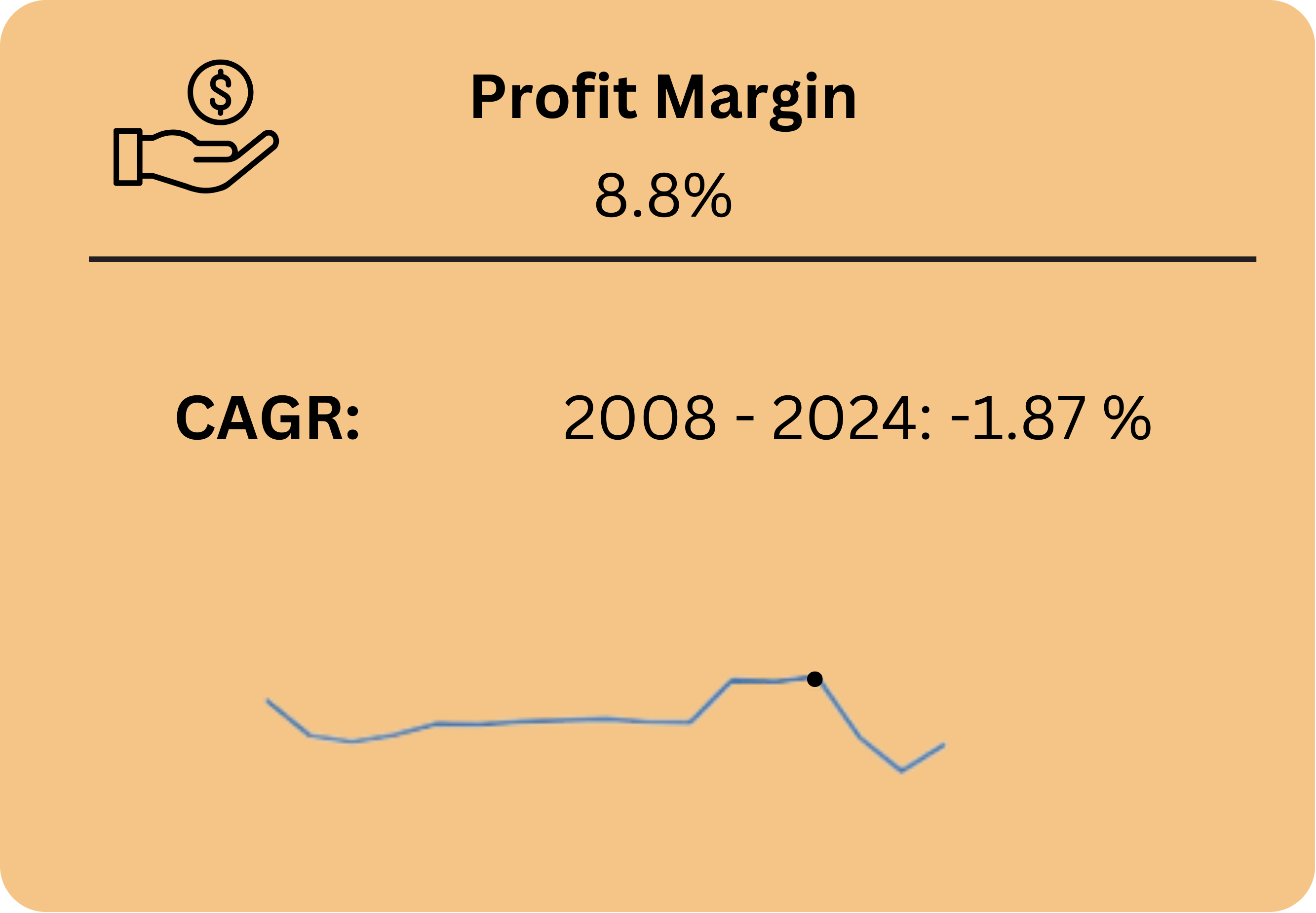

Profit Margin

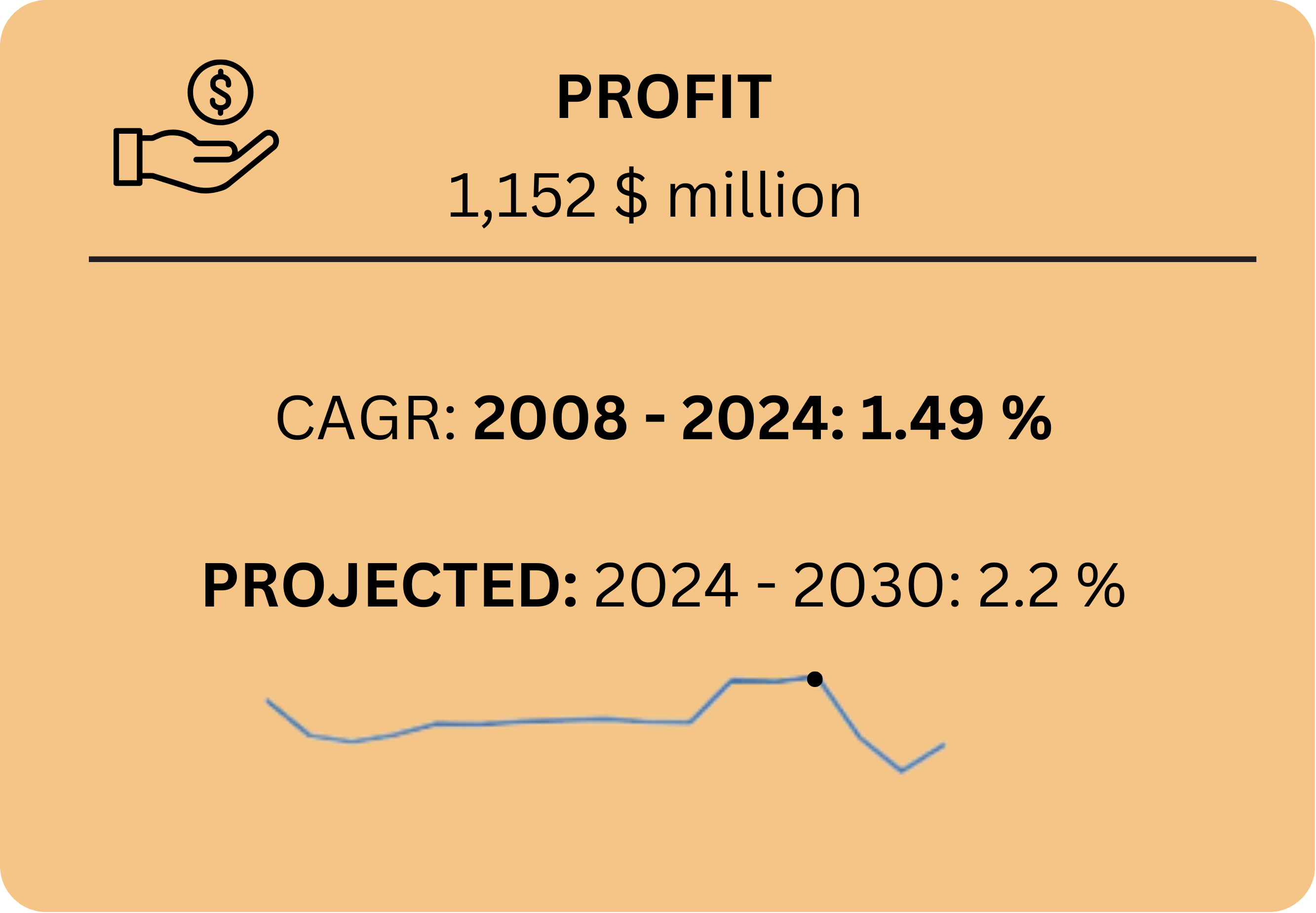

Profitability in the NDIS sector varies depending on service type, compliance costs, and efficiency of operations. Well-run providers with strong governance typically achieve sustainable margins in line with industry averages.Enterprises

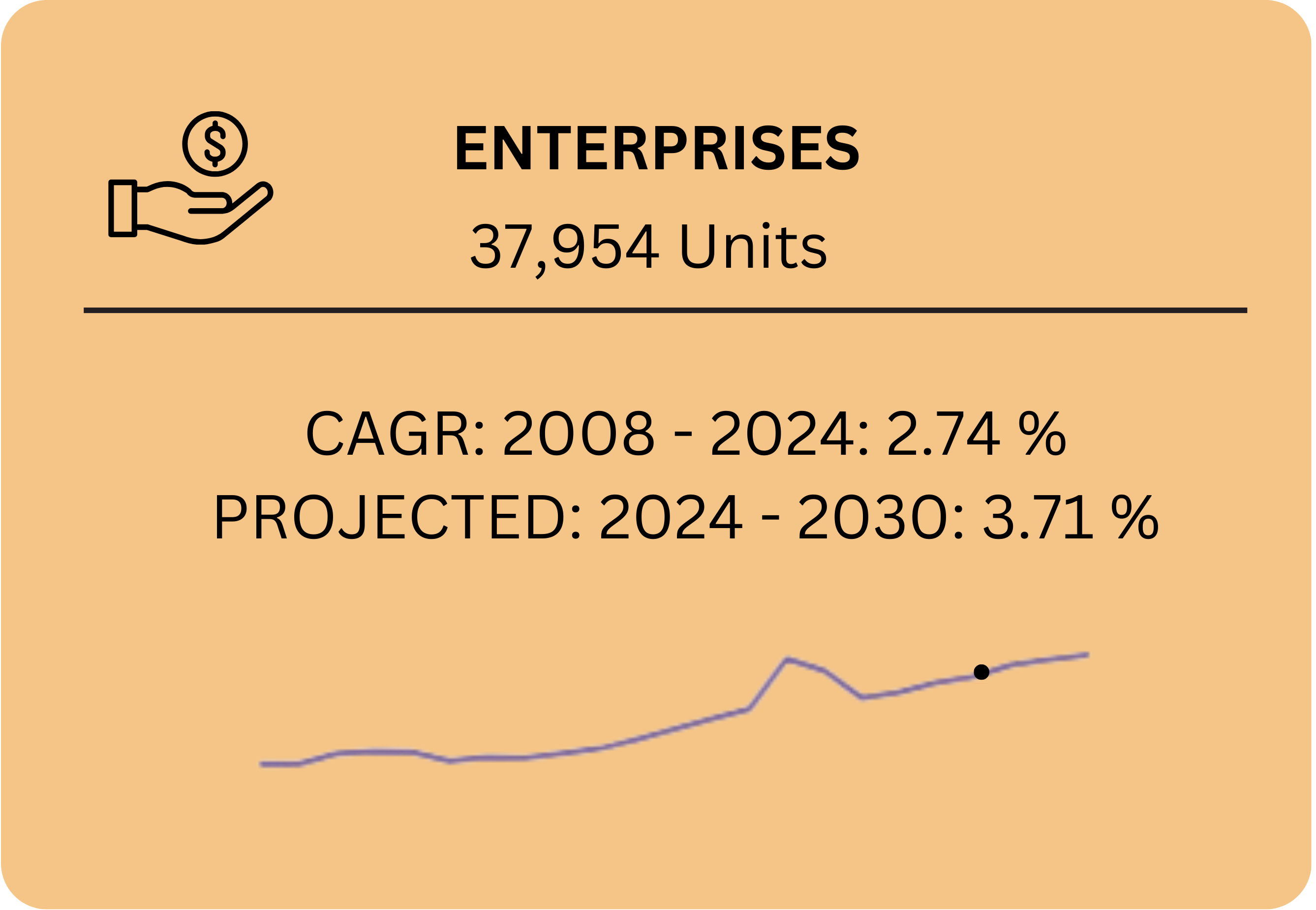

The NDIS sector continues to expand, with thousands of registered providers across Australia. However, the majority are small operators with limited systems and resources, creating opportunities for roll-ups and consolidation into stronger networks.Employment

The sector employs tens of thousands of Australians, including support workers, plan managers, and coordinators—and this number continues to grow as demand for disability services rises nationwide.

As of 2024, the NDIS market in Australia is valued at over $30 billion in government funding annually, with continued growth expected. Demand for reliable, compliant providers is expected to remain strong, supported by structural government commitment and community need.

New business models—such as technology-enabled plan management platforms, digital compliance systems, and centralised administrative support—are reshaping the industry. Families increasingly expect transparency, continuity, and high service quality, creating opportunities for efficient, well-run operators to scale.

Despite compliance complexity, the industry presents strong roll-up potential. Many smaller providers have loyal participant bases but lack the systems or capital to scale. By integrating them into a broader network while preserving their local identity, significant value can be unlocked.

The NDIS sector is widely regarded as resilient and recession-resistant, underpinned by essential service delivery, government backing, and the lifelong importance of disability support.

Geographical Overview

Tangerine Holdings’ acquisition strategy for expanding its presence in the Australian NDIS sector is guided by a geographical overview that considers regulatory settings, participant distribution, household composition, and demand for disability support services. While Tangerine Holdings is committed to a national footprint, it prioritises regions where participant demand is growing rapidly, and the operational environment supports sustainable expansion.

Each state and territory presents distinct market conditions—shaped by participant demographics, workforce availability, and funding dynamics. States like New South Wales, Victoria, and Queensland represent the most fertile ground for acquisitions due to their high participant numbers, diverse service needs, and strong infrastructure for disability support. These urban centres also have higher concentrations of registered providers, creating opportunities for consolidation into stronger, better-resourced networks.

Conversely, smaller states such as Tasmania or the Northern Territory present niche opportunities. Here, Tangerine Holdings may adopt a more selective strategy—focusing on long-standing providers with deep community ties and loyal participant bases but limited access to capital or technology.

By evaluating each region’s regulatory environment, participant growth trends, workforce challenges, and funding patterns, Tangerine Holdings identifies high-potential regions for scalable growth. This targeted approach enables the group to standardise best practices across providers while retaining each business’s local identity and participant relationships.

With the NDIS continuing to expand nationwide and over 600,000 participants accessing supports, Tangerine Holdings is well-positioned to build a sustainable national network—providing critical support to NDIS providers while ensuring long-term impact for participants and communities.

Business Strategy

Tangerine Holdings will focus on acquiring small to medium-sized NDIS providers with strong community reputations and a stable participant base. Ideal acquisition targets will generate between $500K–$5M in annual revenue with healthy EBITDA margins. We prioritise providers with experienced teams, loyal participants, and compliance track records. Each acquisition will undergo thorough due diligence to assess regulatory compliance, service quality, and operational standards. Post-acquisition, we will preserve each provider’s unique identity while introducing centralised support to improve efficiency, compliance, and long-term scalability.

We will invest in modern technology platforms to streamline participant management, compliance reporting, rostering, and billing. By adopting centralised systems across acquired providers, we can reduce administrative burden, strengthen reporting accuracy, and improve service delivery transparency. Technology-enabled plan management and automated compliance tracking will allow providers to operate at scale while maintaining participant trust.

Our acquisition strategy targets regions with high participant concentrations and demonstrated demand for disability support services. States such as Victoria, New South Wales, and Queensland are primary growth markets due to strong participant numbers and funding allocations. In smaller states and territories, we will pursue niche providers with loyal participant bases and community trust.

Our goal is to build a sustainable, national NDIS provider network that maintains local independence while benefiting from centralised systems and resources. By consolidating smaller operators, we will create stronger providers capable of delivering consistent, compliant, and person-centred care. Over time, our network will set the benchmark for quality and efficiency in the sector.

We will introduce centralised finance, HR, and compliance frameworks to reduce duplication and increase efficiency across providers. Standardised operating procedures will ensure consistency, while local teams continue delivering services in line with community needs. Our execution model balances efficiency with respect for each provider’s established culture and relationships.

We will invest in staff development programs to ensure high-quality, compliant, and person-centred service delivery. Training will focus on compliance, safeguarding, and participant engagement, as well as upskilling staff in digital tools that improve efficiency and reporting accuracy. Strong staff retention will remain a priority through cultural continuity and support.

Centralised marketing strategies will be developed to enhance provider visibility and attract new participants. This includes optimised digital campaigns, community engagement initiatives, and participant referral programs. By consolidating resources, we will strengthen brand presence while maintaining each provider’s local identity and trusted reputation.

Our acquisition model addresses common challenges faced by NDIS providers, including:

Limited access to capital for growth and compliance upgrades.

Administrative inefficiencies due to manual processes.

Difficulty maintaining compliance with evolving regulations.

Inconsistent marketing and participant acquisition strategies.

Workforce retention and training gaps.

By solving these issues, Tangerine Holdings creates a stronger, scalable, and compliant provider network that can deliver sustainable long-term outcomes for participants.