Tangerine Holdings

Growing Trusted Petcare, One Happy Pet at a Time.

Tangerine Holdings

Elevating Cleaning Standards, One Space at a Time.

Our Mission

Tangerine Holdings’ mission is to raise the standard of petcare across Australia. We believe that compassionate, high-quality grooming and daycare services are essential to a pet’s health, happiness, and wellbeing. Our goal is to support businesses that provide safe, personalised, and enriching environments for pets—while preserving what makes each business unique.

Our Objective

Tangerine Holdings is focused on acquiring cash-flowing pet grooming and daycare businesses in Australia with strong local reputations and healthy profit margins. Our acquisition strategy prioritises a respectful transition for owners looking to exit, typically over a 12 to 24 month period. We are committed to maintaining the identity and character of every business we acquire, while providing access to centralised support and resources. By operating under a decentralised model, we empower local teams to continue delivering exceptional care to their communities—now backed by a larger network.

Industry Overview

The pet grooming and daycare industry in Australia is part of the broader pet services market, which has seen consistent growth driven by increasing pet ownership, rising disposable income, and the humanisation of pets. Australians now view pets as family members, leading to heightened demand for high-quality grooming, daycare, and wellness services.

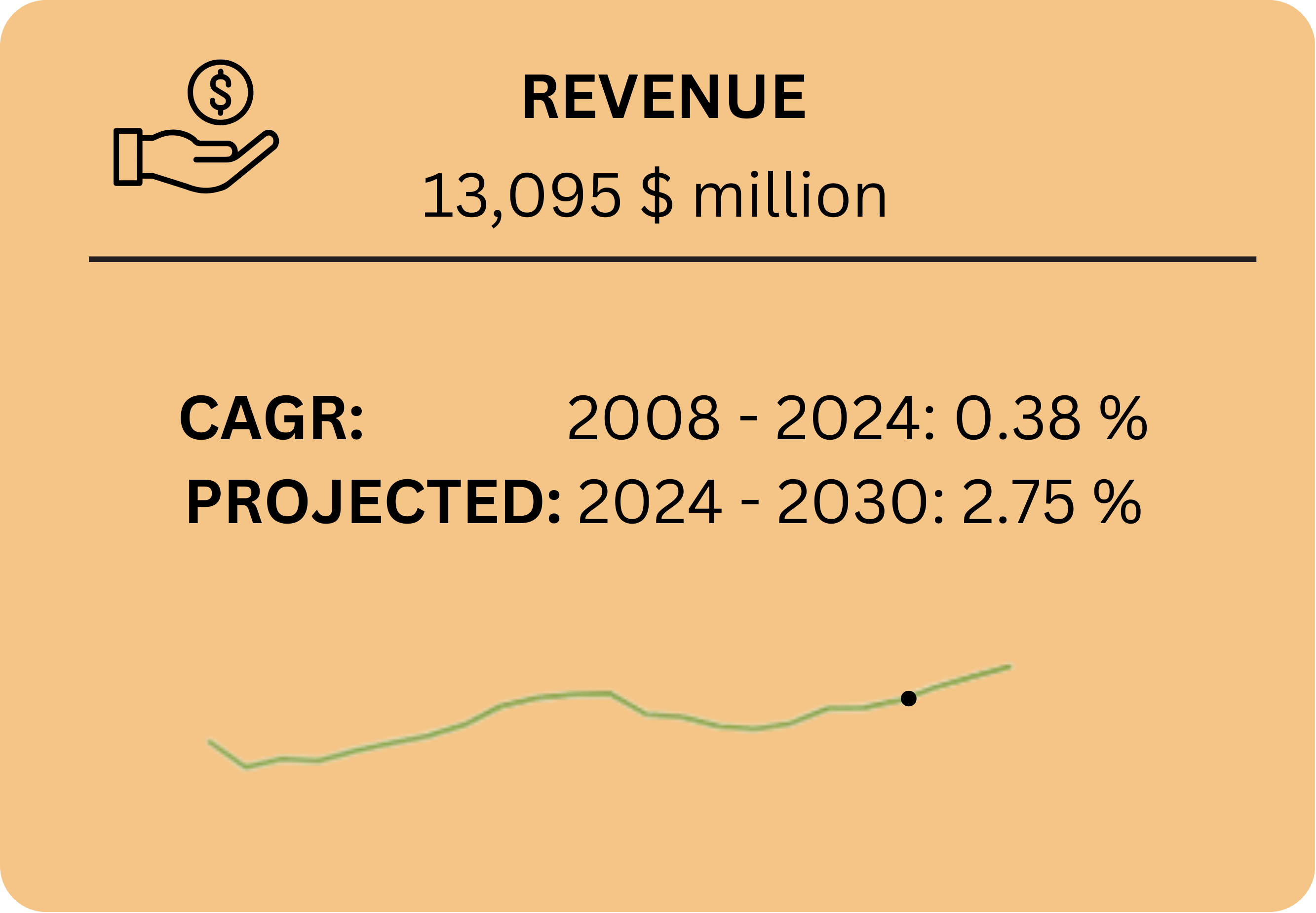

As of 2024, the Australian pet services industry is valued at approximately $3.2 billion, with grooming and daycare services contributing a significant and growing portion of this total. Industry revenue has grown at an estimated CAGR of 4.3% from 2015 to 2024, reflecting the strength of consumer spending on pet wellbeing. Growth is expected to continue at an annualised rate of 5.1% through to 2030, supported by trends such as increased urban living, longer working hours, and demand for convenience-focused services like mobile grooming and pet taxis.

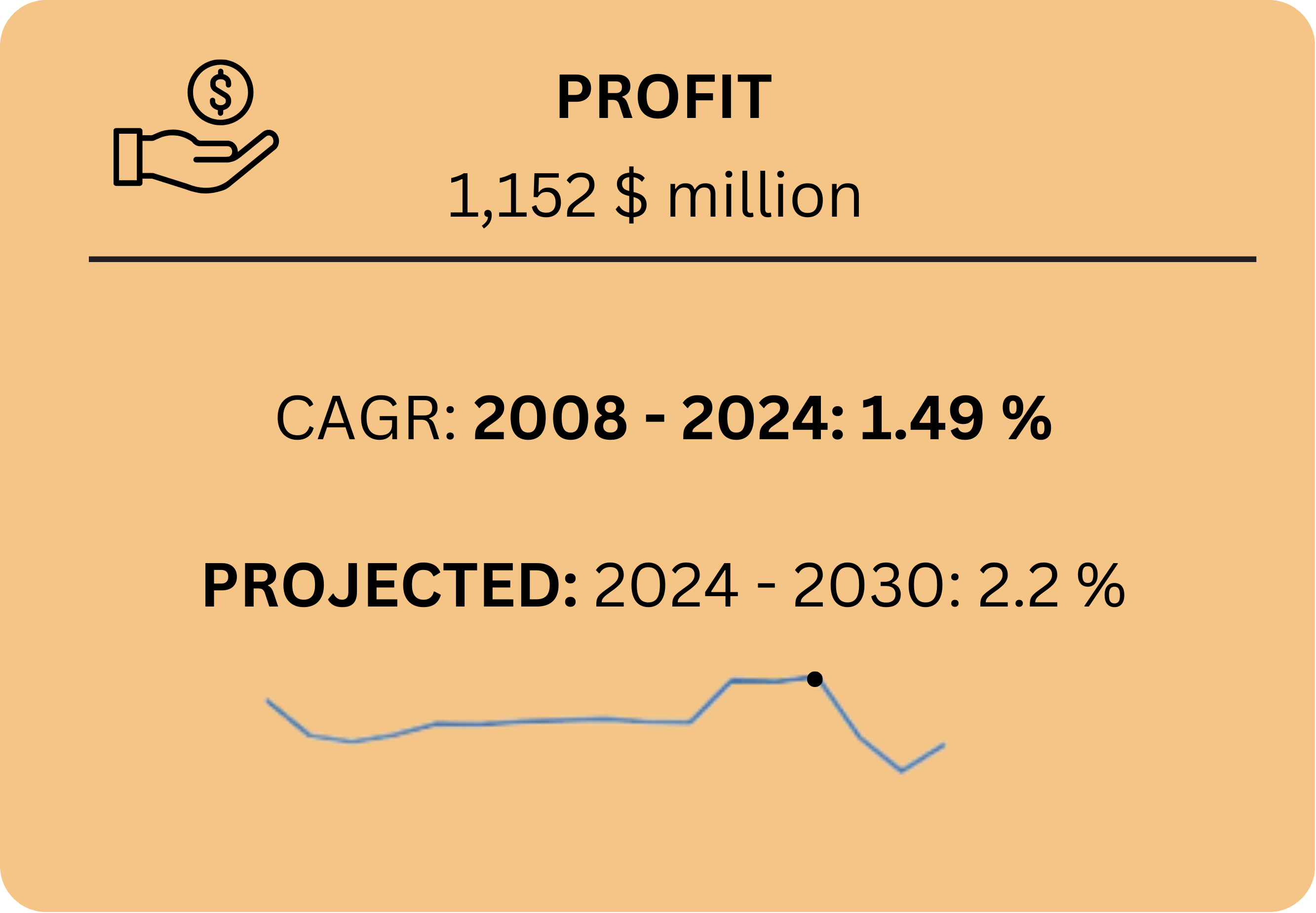

Profit margins in the petcare services sector are healthy, averaging around 15–20%, particularly for boutique businesses that offer personalised care, subscription services, or premium add-ons. However, rising wages, staffing shortages, and increased rental costs—especially in metro areas—pose challenges to operational efficiency and scalability.

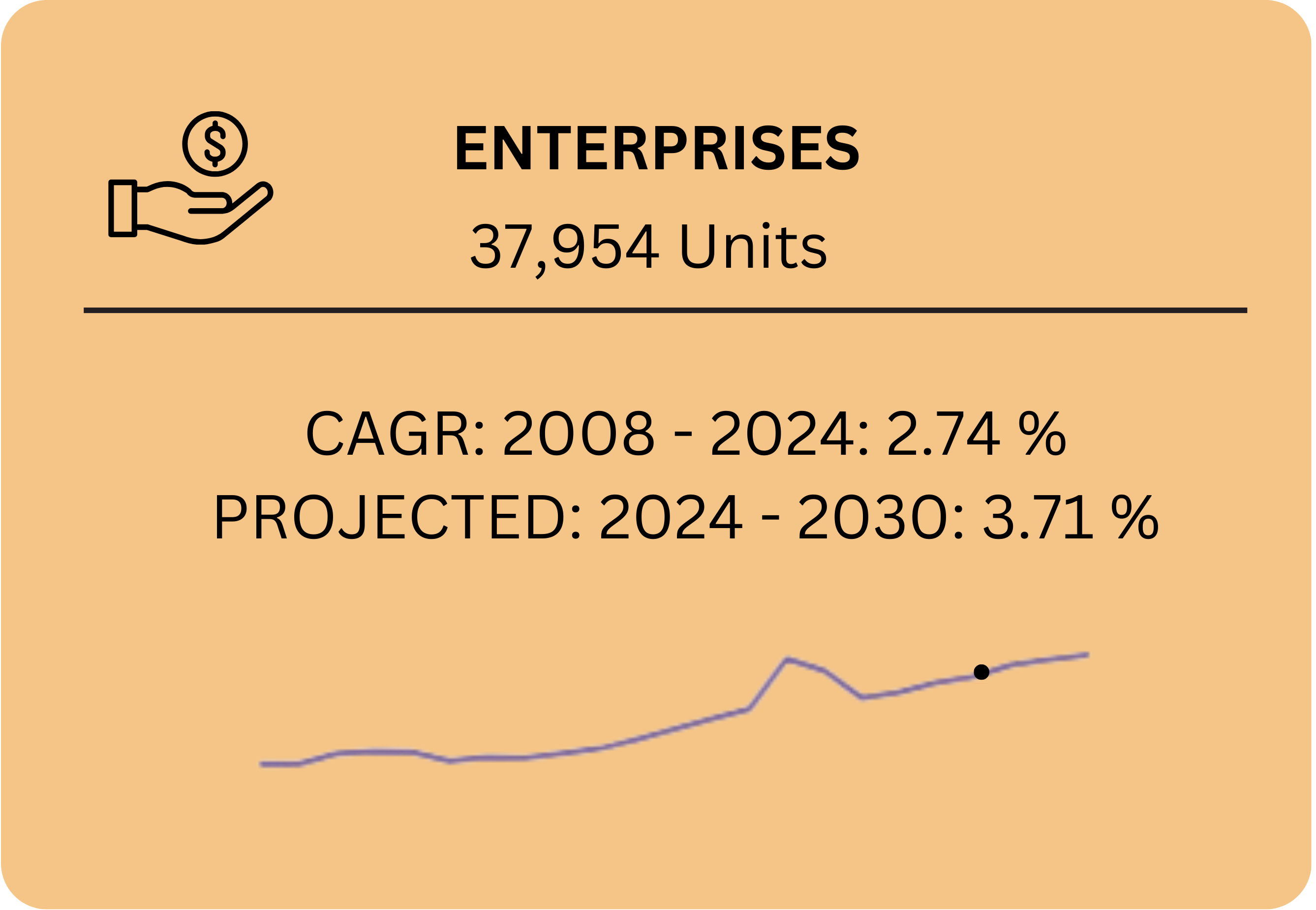

Employment in the industry exceeds 40,000 workers, and this number is expected to climb as the number of pet-owning households increases. However, like many service industries, staffing remains a pain point, with businesses increasingly investing in staff training and digital scheduling tools to improve efficiency and customer satisfaction.

Innovation in service models—including app-based booking, live pet monitoring, and mobile services—is reshaping how grooming and daycare businesses operate. Consumers now expect seamless digital engagement and high standards of hygiene, safety, and care. Additionally, increasing regulation and licensing requirements around animal welfare are shaping business practices and compliance needs, particularly for daycare providers.

Despite these complexities, the petcare sector presents compelling acquisition opportunities. Many small, independent operators have built loyal customer bases but lack the capital, technology, or systems to scale. This creates room for roll-up strategies focused on preserving local charm while introducing operational consistency and efficiency.

With Australia’s pet population nearing 30 million and spending per pet rising year-on-year, the industry is expected to remain resilient and recession-resistant—driven by emotion, loyalty, and the unwavering desire of Australians to provide the best for their pets.

Geographical Overview

Tangerine Holdings’ acquisition strategy for expanding its presence in the Australian pet grooming and daycare industry is guided by a geographical overview that considers regulatory settings, pet ownership rates, urbanisation, and disposable income across states and territories. While Tangerine Holdings is committed to growing its national footprint, it will prioritise regions where petcare demand is strong and the regulatory landscape is conducive to responsible operations.

Each state and territory presents distinct market dynamics, including varying local council regulations, access to qualified staff, and customer demographics. For instance, New South Wales and Victoria are home to a large proportion of pet-owning households and have dense metropolitan centres, making them ideal locations for grooming and daycare acquisitions. These states also tend to have a higher concentration of dual-income households, which increases demand for pet services like daytime care and regular grooming.

By contrast, Tangerine Holdings may adopt a more targeted approach in smaller or less densely populated markets such as Tasmania or the Northern Territory. In these regions, the focus will be on niche businesses that have developed loyal client bases and strong community ties.

By closely assessing local demand drivers, regulatory environments, and competitive density in each state, Tangerine Holdings aims to identify the most promising opportunities for sustainable growth. This considered approach ensures the company can scale effectively while maintaining the high standards of care and customer service that pet owners across Australia expect.

The company recognizes that each state and territory has its unique market dynamics and regulatory requirements, which can impact business operations and growth potential. For instance, states like New South Wales and Victoria offer significant opportunities due to their large commercial hubs and high concentration of businesses, making them prime targets for acquisition. On the other hand, Tangerine Holdings may approach expansion in states with smaller markets, such as Tasmania and the Northern Territory, more cautiously, focusing on niche opportunities that align with its overall growth strategy.

By carefully assessing the market and regulatory conditions in each state, Tangerine Holdings aims to identify the most promising opportunities for growth while minimizing potential risks. This strategic approach allows the company to build a strong and sustainable presence in the Australian commercial cleaning industry, ensuring long-term success across diverse geographic areas.

Business Strategy

Tangerine Holdings will focus on acquiring small to medium-sized pet grooming and daycare businesses with a strong local presence in major Australian cities. Target companies should generate at least $500K–$1M in annual revenue with healthy profit margins. We will prioritise businesses offering specialised services or loyal client bases. Each acquisition will undergo thorough due diligence to ensure cultural and operational alignment. Post-acquisition, we will preserve each brand’s unique identity while providing centralised support to enhance efficiency and long-term growth.

To drive operational excellence, Tangerine Holdings will invest in digital tools that improve customer experience and service efficiency. Appointment scheduling systems, pet report cards, and mobile apps will be introduced to streamline bookings, track pet services, and enhance client communication. Data insights will support decision-making across our network, helping us improve performance, optimise staffing, and deliver consistent, high-quality care to pets and their owners.

Tangerine Holdings’ geographic expansion in the petcare sector will prioritise acquiring established grooming and daycare businesses in major Australian cities such as Sydney, Melbourne, Brisbane, and Perth. These urban centres have the highest pet ownership rates and strong demand for premium pet services, driven by busy lifestyles and a growing emphasis on pet wellbeing.

Tangerine Holdings is committed to raising the standard of petcare services in Australia by promoting quality, compassion, and sustainability. Our long-term goal is to become a trusted leader in ethical, eco-conscious pet grooming and daycare, ensuring animal wellbeing through innovative practices and responsible business growth.

To ensure consistency and efficiency, Tangerine Holdings will implement standardised procedures across all acquired petcare businesses. This includes shared best practices, unified technology platforms, and quality controls. Centralised support functions such as HR, finance, and marketing will be provided, allowing local teams to focus on delivering exceptional care.

The success of Tangerine Holdings depends on the care and skill of our team. We will focus on hiring compassionate, experienced professionals in grooming and animal handling. Ongoing training programs will ensure staff stay current with pet wellness standards, safety practices, and customer care, supporting both new hires and existing teams.

Our plan is to retain the original business name and branding, preserving its unique character and legacy. This approach not only respects the founder’s legacy, which is often important to retiring sellers, but also provides competitive advantages over larger, branded acquirers.

High competition in the petcare industry will be addressed by acquiring well-established businesses with loyal customer bases and premium offerings. We will differentiate through service quality, technology adoption, and ethical practices. Our emphasis on trust, brand continuity, and personalised care makes our model difficult to replicate.