Tangerine Holdings

Acquiring Waste Management Businesses Across Australia.

Tangerine Holdings

Elevating Cleaning Standards, One Space at a Time.

Our Mission

Tangerine Holdings’ mission is to raise the standard of cleanliness, hygiene, and waste management across Australia. We believe that clean spaces and responsible waste handling are essential to health, productivity, and peace of mind. Our goal is to support and grow businesses that deliver reliable, eco-conscious cleaning and waste services — helping them thrive while keeping our environments safer and more sustainable.

Our Objective

Tangerine Holdings is actively acquiring cash-flowing cleaning and waste management businesses across Australia with an EBITDA margin between 18% and 26%. We focus on companies with stable operations and recurring revenue — including general waste collection, skip bin hire, recycling, and commercial cleaning services.

Our acquisition strategy began in 2024 and prioritises smooth transitions, with most handovers completed in 6 to 18 months. We work closely with owners to protect the legacy of each business, ensuring continuity for staff and customers alike. Tangerine Holdings operates with a decentralised structure, allowing each business to retain its unique brand and identity while gaining the benefits of centralised support and shared operational resources.

Industry Overview

Tangerine Holdings is actively acquiring profitable waste management businesses across Australia, with a focus on operators delivering essential services like general waste collection, skip bin hire, recycling, green waste removal, and construction waste solutions.

Australia’s waste management industry is undergoing rapid change, driven by population growth, construction activity, and increasing environmental regulation. In 2024, the industry generated over $12 billion in revenue, with forecasts projecting strong continued growth as businesses and governments prioritise landfill diversion, recycling, and sustainable resource recovery.

Emerging trends in the sector include:

Increased demand for commercial and industrial waste services

Ongoing consolidation of smaller regional operators

Investment in waste technology and logistics efficiency

Stricter compliance obligations for tracking, disposal, and recycling

At Tangerine Holdings, we’re particularly interested in waste businesses with:

Recurring commercial contracts

Strong cash flow and route density

Established local brand presence

Systems and staff in place independent of the owner

By supporting operators in this space with capital, centralised resources, and long-term succession planning, we help preserve legacy while creating scale and operational efficiency.

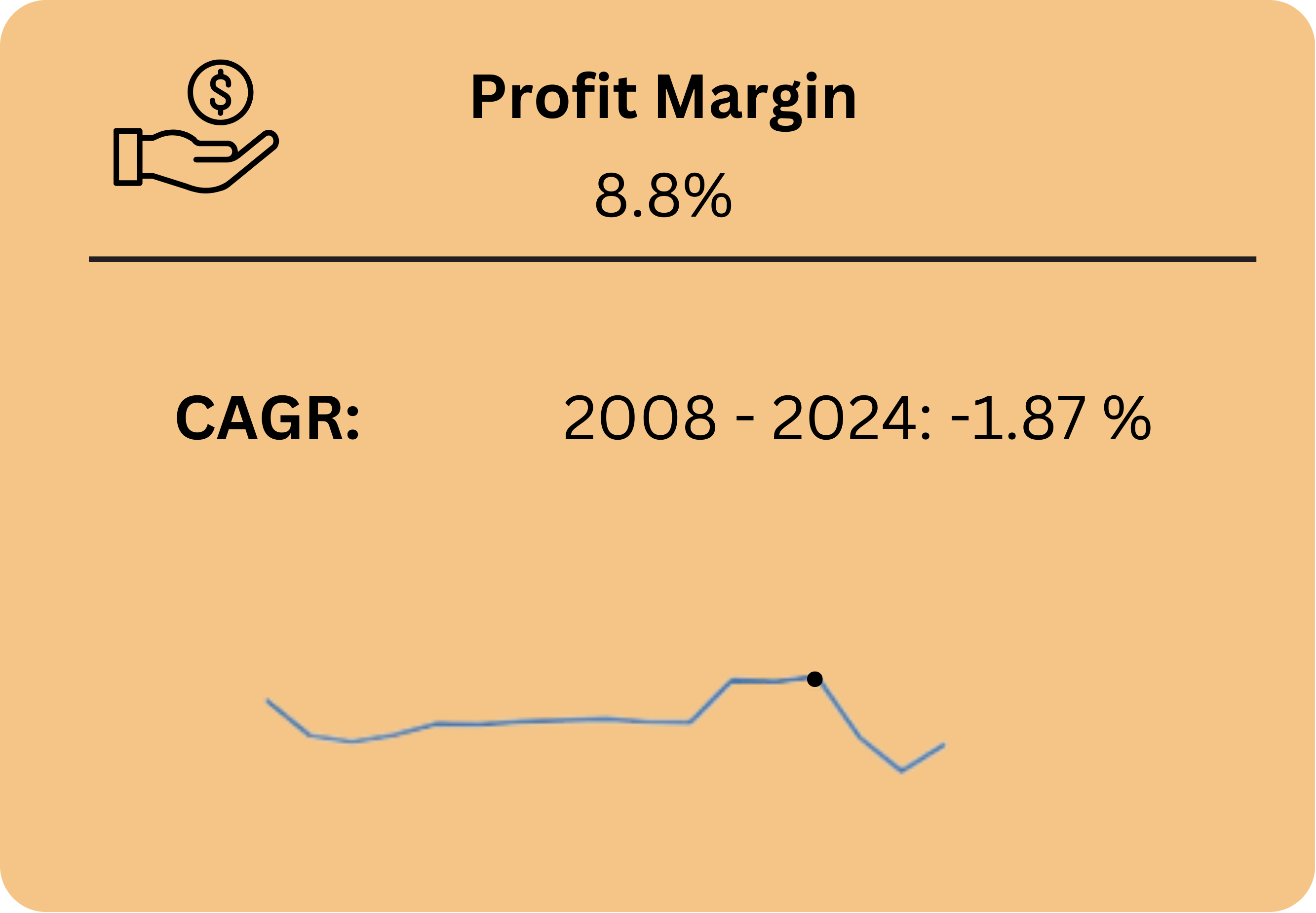

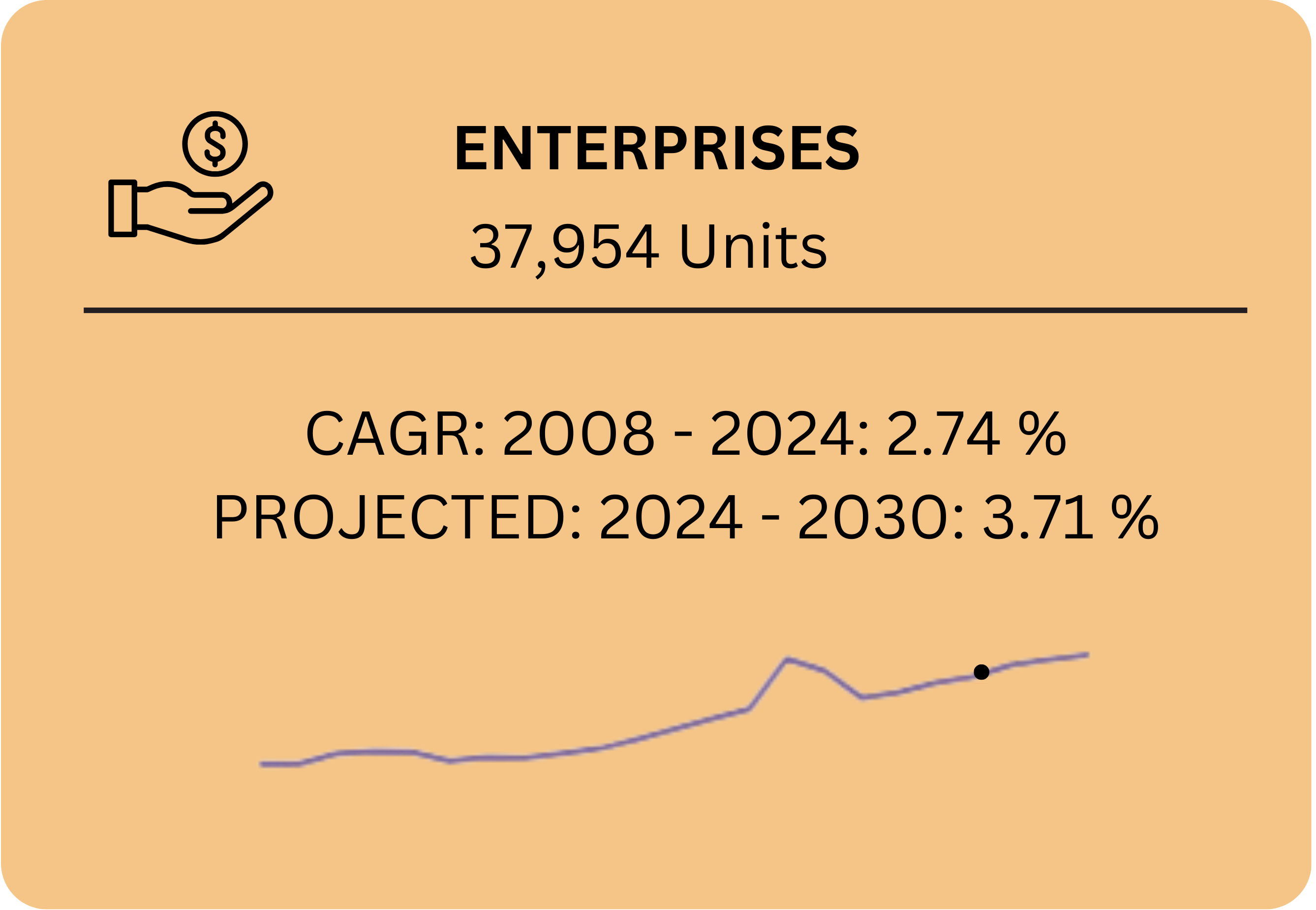

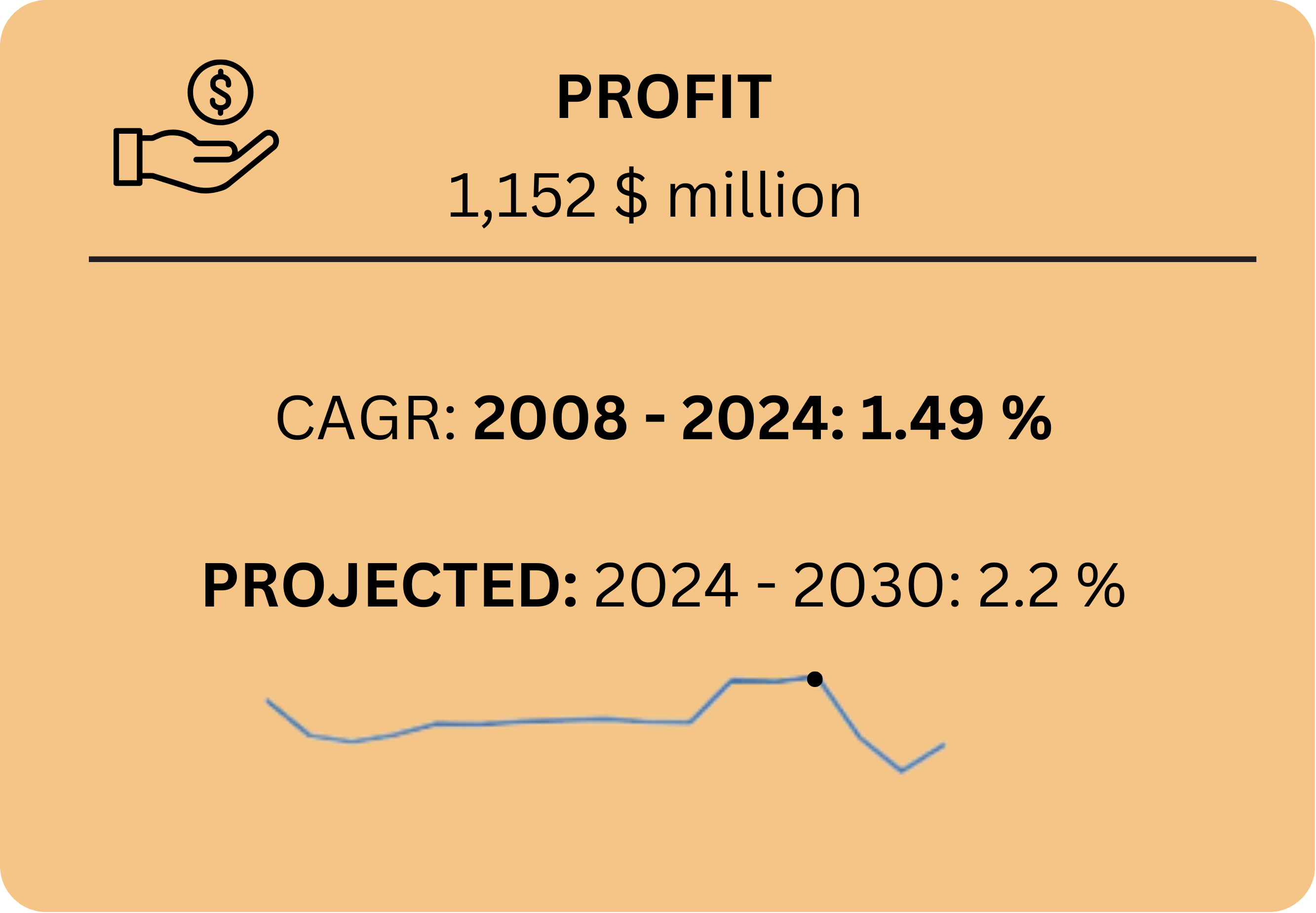

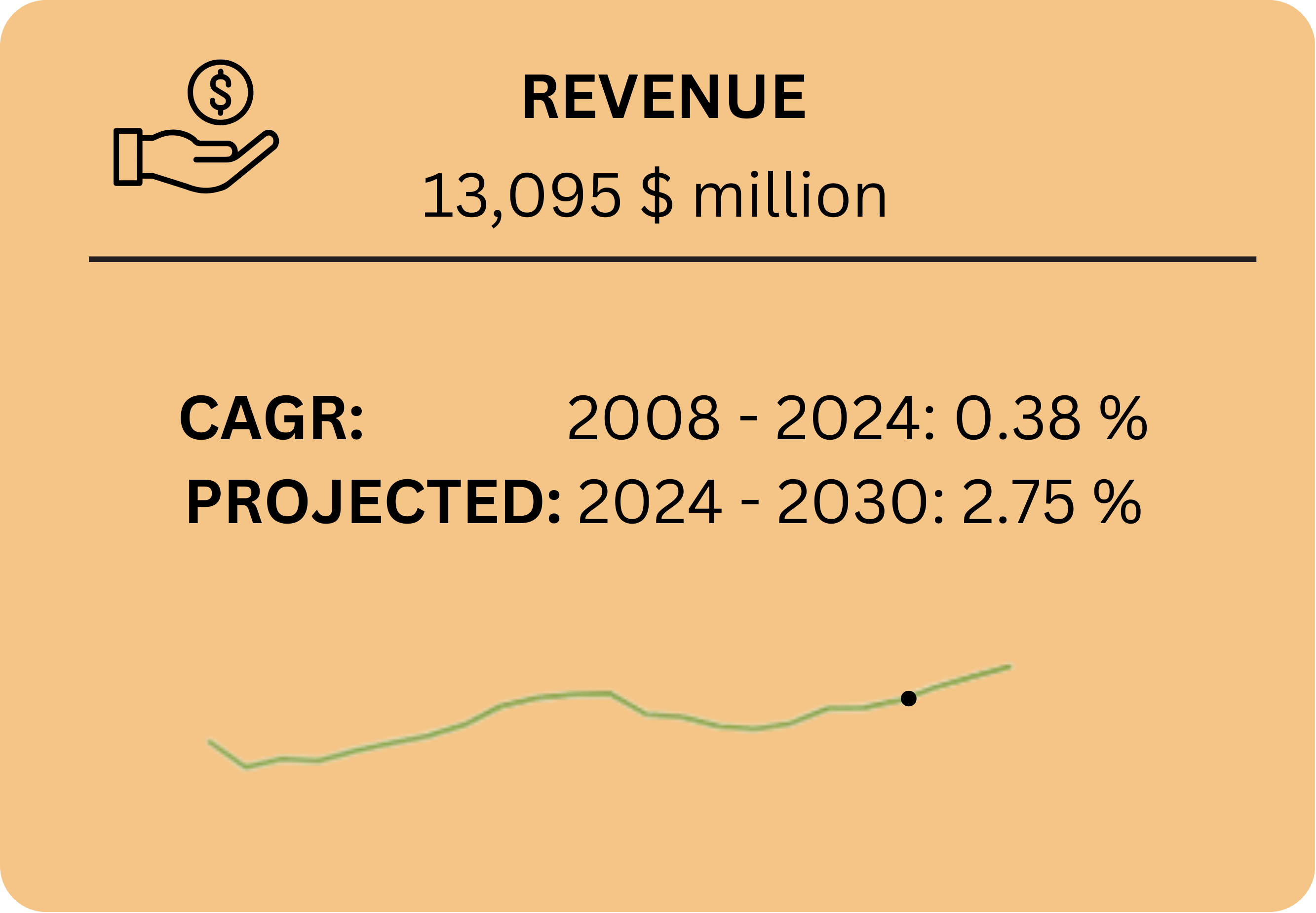

In 2024, the industry recorded a profit of $1.152 billion, with a profit margin of 8.8%. However, the industry faced a compound annual growth rate (CAGR) decline of 1.49% in profit and 1.87% in profit margins from 2008 to 2024. This decline reflects the industry’s struggle to maintain profitability amidst rising costs and fluctuating demand. The industry’s revenue stands at $13.095 billion in 2024, with a modest CAGR of 0.38% from 2008 to 2024. Despite the challenges posed by the pandemic, the industry is projected to experience a revenue growth of 2.75% from 2024 to 2030, indicating a positive outlook driven by increasing demand for specialised cleaning services. Employment in the industry totals 146,641 units in 2024, with a CAGR of 1.80% from 2008 to 2024. However, employment is projected to decline by 1.68% from 2024 to 2030, as firms invest in efficiency technologies that reduce the need for labour.

- The IVA, which measures the industry’s contribution to the economy, stands at $6.511 billion in 2024. The IVA has grown at a CAGR of 1.09% from 2008 to 2024 and is expected to accelerate to a CAGR of 1.97% from 2024 to 2030, reflecting the industry’s recovery and growing economic importance.

The commercial cleaning industry is expected to return to a stable growth trajectory over the coming years. The number of businesses in Australia is projected to increase, driving demand for commercial cleaning services. Additionally, the growing awareness of the importance of hygiene and cleanliness, particularly in the wake of the pandemic, is expected to boost demand for specialised cleaning services. Investment in efficiency technologies, such as smart sensors and employee apps, is forecast to reduce labour costs and improve profitability. However, the industry will need to adapt to increasing environmental and sustainability requirements, with larger firms already taking steps to reduce their carbon footprint and water usage. Overall, the industry is poised for a period of steady growth, with revenue projected to rise at an annualised rate of 2.8% through 2028-29, reaching $15.0 billion.

Geographical Overview

Our acquisition strategy in the waste management sector is informed by regional demand patterns, population growth, infrastructure investment, and local regulatory conditions.

We prioritise acquiring waste businesses in states where:

Construction and demolition activity is high

Urban and suburban population density drives service demand

Environmental targets (e.g. landfill diversion) are enforced

Industry compliance is tightening — creating opportunities for well-run operators

Priority Regions:

New South Wales: High concentration of commercial, construction, and infrastructure projects — strong skip bin and waste collection demand.

Victoria: Robust recycling initiatives, population growth corridors, and strong council/commercial service demand.

Queensland: Expanding metro areas and regional growth hotspots create strong waste collection opportunities.

Western Australia: Industrial and mining-linked waste generation drives demand for specialised services.

South Australia & Tasmania: Smaller but stable markets with high potential for recurring route-based services.

We assess each state based on:

Number of licensed waste operators

Existing market fragmentation

Regulatory shifts favouring compliance-ready businesses

Long-term service demand based on demographics and construction cycles

Tangerine Holdings is committed to becoming a trusted partner for waste business owners seeking succession, exit, or scale — while respecting the local impact and legacy of each company we acquire.

The company recognizes that each state and territory has its unique market dynamics and regulatory requirements, which can impact business operations and growth potential. For instance, states like New South Wales and Victoria offer significant opportunities due to their large commercial hubs and high concentration of businesses, making them prime targets for acquisition. On the other hand, Tangerine Holdings may approach expansion in states with smaller markets, such as Tasmania and the Northern Territory, more cautiously, focusing on niche opportunities that align with its overall growth strategy.

By carefully assessing the market and regulatory conditions in each state, Tangerine Holdings aims to identify the most promising opportunities for growth while minimizing potential risks. This strategic approach allows the company to build a strong and sustainable presence in the Australian commercial cleaning industry, ensuring long-term success across diverse geographic areas.

Business Strategy

Tangerine Holdings will strategically focus on acquiring small to medium-sized waste management businesses with a solid market presence in key Australian regions. We target businesses with at least $1 million in annual revenue and an EBITDA margin between 18% and 26%. Our ideal acquisition provides essential services such as general waste collection, skip bin hire, green waste, recycling, or construction waste removal.

We prioritise businesses with consistent commercial contracts, reliable operational processes, and potential for regional expansion. Due diligence will ensure alignment with our long-term vision of building a decentralised network of waste service providers that retain their local identity while benefiting from shared resources and strategic oversight.

We actively invest in digital tools and operational platforms to help optimise route efficiency, customer service, compliance reporting, and logistics for acquired waste businesses. This includes modernising fleet tracking, customer booking systems, and EPA-aligned waste reporting.

We focus on high-demand growth corridors, including metro and regional areas where construction, population growth, or environmental regulations drive stable demand. Key target states include NSW, VIC, QLD, and WA, with selective acquisitions in smaller markets for strategic coverage.

Our long-term vision is to build a national network of waste service providers that are profitable, compliant, and sustainable — offering high-quality services across residential, commercial, and industrial waste streams. We aim to elevate operational standards while supporting Australia’s transition to a circular economy.

We implement systems that improve operational efficiency post-acquisition — from centralised admin and finance to route planning and fleet maintenance. However, we retain each brand’s operational autonomy to preserve customer trust and team continuity.

We invest in onboarding and upskilling local staff, ensuring a smooth transition and preserving service quality. Our goal is to empower teams with better tools, support, and structured career development, not replace them.

We help acquired businesses grow with targeted advertising, SEO, lead generation campaigns, and brand refreshes — while preserving their established reputation and local connections.

Through our acquisition model, we address common waste industry challenges such as:

Owner-dependence and succession planning

Fragmented operations and underutilised fleet

Regulatory compliance complexity

Limited marketing and tech investment